Emerging managers in the US are on track for their worst fundraising performance in seven years, with total commitments expected to come in below $20 billion. This difficult fundraising environment is likely to exacerbate regional schisms and create more competition between already cash-hungry startups.

Historically, emerging firms have invested in niche areas and early-stage startups, while also focusing on geographically underrepresented areas, like those outside of San Francisco and New York. PitchBook defines emerging managers as firms that have launched fewer than four funds. Emerging managers are also known to partner with larger, experienced firms to help scout out startups. Ultimately, if emerging managers' challenges continue, there is a risk the VC ecosystem will shrink, limiting innovation and dealmaking, according to PitchBook analyst Max Navas, who authored a recent report on the subject.

"If I'm an entrepreneur and I have my choice of starting a company in Milwaukee, versus San Francisco, and I know that Milwaukee has a way smaller amount of dry powder or managers in the area, I'd go to where the capital is, even if there's greater competition," Navas said.

"They fund dealmaking at the earliest stages," he added. "With fewer managers out there, I think we're going to see fewer startups find success."

Despite historically high fundraising within the VC space, with a record $171 billion raised in the US in 2022, emerging managers' fundraising peaked in 2021—and there's no indication that momentum is building back up.

For the first time since PitchBook began collecting data, experienced managers closed more funds than emerging managers. Historically, emerging managers have closed nearly two to three times the number of funds that their more experienced peers do, according to Navas.

Even successful funds are showing signs of strain: The average fund size for an emerging manager is now $41.7 million, less than half what it was last year.

The current economic environment is making it hard for LPs to want to invest in firms without a track record, according to Navas, who pointed out that the firms currently benefiting the most are those with strong networks. Endowments and both public and private pension funds are committing less capital to emerging managers and recommitting at even lower rates. Navas estimates that the gap between experienced and emerging managers is about 11 to one.

"When you're an emerging manager, you have to fundraise from your immediate network, you don't have the brand name and the proven track record to attract LPs on their volition," Navas said.

Exploring The Q1 ‘23 Emerging Manager Report

If you’re into this, I recommend reading the full report here. Now on to the points that jumped out to me.

91% of emerging managers are finding fundraising difficult or very difficult

A majority of the funds Pitchbook reports were closed in 2022 were mostly committed in 2021 and Q1 of 2022. Since then, the market has been almost completely frozen amongst some large institutional LP’s. Many of the new funds being announced recently (and showing up in the 2022 and 2023 data) were technically raised quite awhile ago. In fact, a common strategy for anyone raising capital is to announce the prior fundraising event when you start the next one…

If you look at startup exits (liquidity events), they’ve been practically non-existent for the past six quarters. These startups exiting and returning capital to VCs and their investors (LPs) is typically what funds the majority of capital being invested into the venture capital asset class. But who can blame them? Valuations are down significantly since 2021. It also means valuations are down in other asset classes, which institutional LPs will likely need to sell in to make new venture investments.

None of this bodes well for emerging managers. It’s the riskiest sub-asset class within venture capital, of which is one of the riskiest asset classes. This makes it very impacted during funding pullbacks.

There is good news though, as three private venture-backed companies (ByteDance, Stripe, and SpaceX) alone are probably worth somewhere between $300 to $500 billion in total today. If even 20% of that value is re-invested into venture, that represents at least $60 billion in capital waiting to be redeployed. This could get us to back to 2014-2017 levels.

32% of emerging managers have decreased their target fund size

Anecdotally, this seems very low. Part of it may be the sheer will and determination to stick with it through tough times. But it may also reflect responses from managers who haven’t fundraised within the past year.

One thing I saw very frequently was emerging managers that just stopped fundraising entirely last year. I know many that had sizeable commitments by Q1 of 2022 and simply closed the fund when the market dried up. This could match with the 59% that aren’t currently raising and don’t plan to within the next 12 months in the report.

Only 26% of the survey respondents were or plan to remain solo GPs

One reason solo GPs might seem more prevalent than they are is due to the nature of how it works. As an extreme example, there might 20 investors at one firm and 20 solo. It’s 40 investors total, the world sees 21 unique venture firms, and 20 of them are solo GP’s.

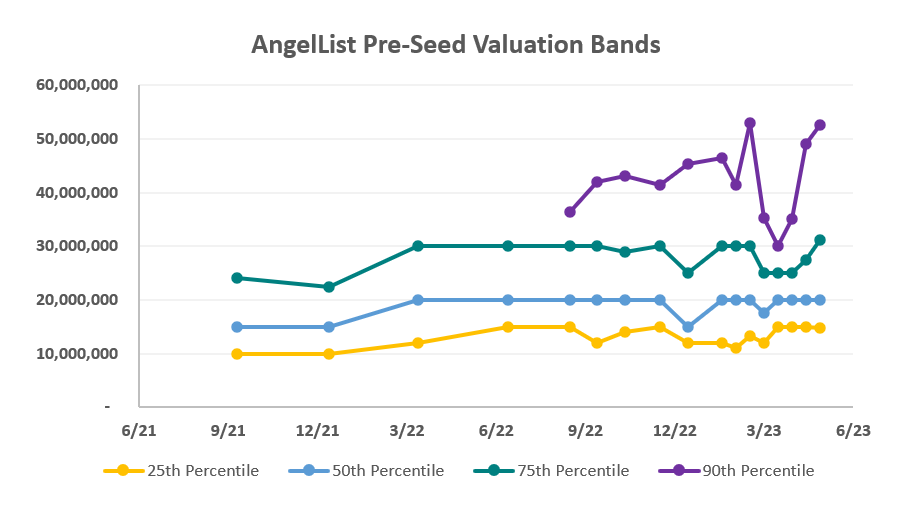

67% saw valuations decrease in Q1, while 78% saw more or the same deal flow

Similar story at Seed, valuations on the highest valued rounds came down noticeably throughout Q1 (before also trending back up again).

I wonder how much of this was SVB related?

Biggest Challenges: Fundraising and Deal Flow

39% said their biggest challenge was not seeing enough high quality startups, and 15% said more deal flow would be helpful. In aggregate, emerging managers feel like they’re seeing good opportunities.

AI is Overhyped, Longevity is Underhyped

Opinions on the most underhyped areas were more diverse. Longevity took the lead with 8%, and I personally could believe this as I don’t think I’ve ever heard anyone talk my ear off about extending my life expectancy. I’d be curious to know how exactly everyone voted on this one.

All said, it’s fascinating to see how emerging venture managers are thinking. I’m crossing my fingers they keep publishing these quarterly.

The full report has 10x more data than I highlighted - check it out here.